The do’s and don’ts of Directors’ duties

20 Jun 2024

All Eyes on Corporate Officers

On 27 March 2024, we released a summary of the Regulatory Posture published by the Registrar of Indigenous Corporations (ORIC Registrar). As part of this Regulatory Posture, the Registrar placed a heavy focus on monitoring and regulating the conduct of officers of Aboriginal corporations who have, or are suspected to have, acted in non-compliance with their duties under the Corporations (Aboriginal and Torres Strait Islander) Act 2006 (Cth) (CATSI Act).

Failures of corporate governance and breaches of directors’ duties are commonly cited by the Registrar when placing a corporation into special administration. For example, recently, an Aboriginal corporation in Queensland was placed into special administration following an examination, and the Registrar stated that:

“The examination found significant non-compliance issues and that directors had been failing in their duties, particularly in relation to financial controls and management.”

A Snapshot of Directors’ Duties

Once a director is appointed, they have a high degree of responsibility in the efficient functioning and management of their corporation. Directors’ duties exist to keep directors in check and ensure that directors act in a way that is consistent with the interests of the members and the corporation as a whole.

Under s 265-1 of the CATSI Act, directors and other officers are required to exercise their powers and carry out their duties with a reasonable degree of care and diligence. A director must be careful when making decisions and ensure that their decisions are made with proper care and skill and do not break any laws. This does not mean that a director must be an expert on everything. But if a director is unclear or confused about an issue, they should get all the information they need (maybe from an outside expert) to make an informed decision.

Directors have a duty to act in good faith and act in the corporation’s best interests under section 265-5 of the CATSI Act. This means that directors should demonstrate loyalty and honesty in all dealings with the corporation and with each other. This duty does not require that all stakeholders be satisfied with every decision of the Board, but directors must genuinely believe their decisions to be the best decisions for the corporation, considering the relevant circumstances.

Sections 265-10 and 265-15 of the CATSI Act instruct directors not to use their position, or information obtained by virtue of their position, in such a way as to gain an advantage for themselves or another person or cause the corporation harm.

Directors have a duty to disclose material personal interests under s 268-1 of the CATSI Act. This means that Directors must tell each other their personal interests in matters relating to the affairs of the corporation. Directors must avoid making decisions about the corporation which could personally benefit them or their family or their personal businesses. At all times, the corporation’s interests come first.

Under s 531-1 of the CATSI Act, directors have a duty to not allow the corporation to trade when it does not have sufficient funds to maintain these dealings. A director will have breached their duty to not allow the corporation to trade while insolvent if he or she authorises a transaction or makes a decision which would result in the corporation being unable to pay its debts as and when they become due.

Key Takeaways for Directors

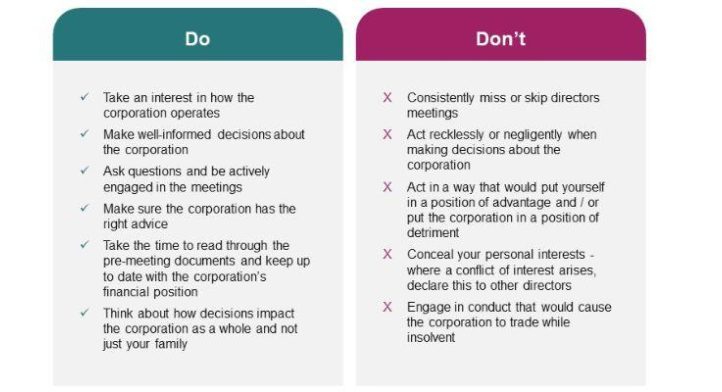

We've outlined the do's and don'ts and key takeaways for Directors to be aware of:

Assistance from Jackson McDonald

Jackson McDonald’s experienced team can help deliver corporate governance training and assistance to boards of Aboriginal corporations, including training about directors and officers duties. On the ground, we can provide relevant and customised learning packages, tailored to suit the needs of your corporation. If you would like more information about the types of governance support that we offer, please contact Emma Chinnery or Alana Schwartz.